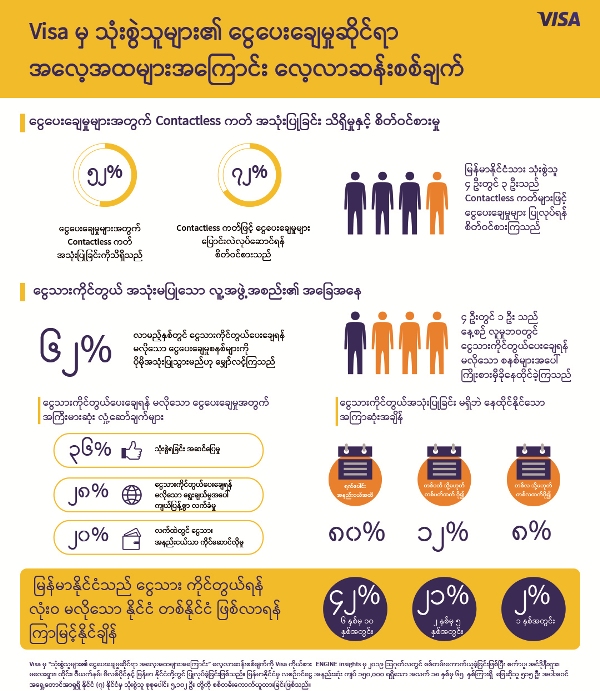

According to Visa, about 72% of visa users want to switch to Contactless Card Payment

Visa, the world’s leader in digital payments, revealed that nearly three in four (72 percent) of Myanmar consumers have expressed a clear interest in adopting contactless card payments.

The findings are based on the Visa Consumer Payment Attitudes Study which tracks payment habits and attitudes as well as explores emerging topics related to payments.

The study also uncovered that over half (52 percent) are now aware of using the contactless cards for payments, compared to only 10 percent just a year ago.  Photo Source https://web.facebook.com/VisaMM/

Photo Source https://web.facebook.com/VisaMM/

Lillian Wang, Country Manager for Visa Myanmar, said: “Digital payments have never been more central to economic growth and societal progress. Advances in the movement of money are catalysts for innovation and are vital to open, inclusive, and connected communities. As a leader in digital payments, we are committed to helping consumers and businesses in Myanmar to realize the benefits of digital payments, while finding ways to expand access to digital payments that are fast, convenient, and secure.”

Top places where respondents use their contactless cards to make payments are during overseas travel, followed by supermarkets and dining.

The Study also delved into usage between age demographics. It shows that the younger Gen-Y (25-39 years old) are four times more likely than Gen-X (40-54 years old) to forgo carrying around cash (4 percent vs 1 percent). While Gen-Y is more aware of contactless cards (52 percent) and mobile contactless payments (39 percent), members of Gen-X also show significant awareness of both forms of contactless technology (40 percent and 26 percent respectively).  Photo Source https://web.facebook.com/VisaMM/

Photo Source https://web.facebook.com/VisaMM/

Of those who use cashless payment methods, more than three in five (62 percent) expect to increase their usage in the next year. The biggest factors motivating this are convenience (36 percent), wider acceptance of cashless options (28 percent), and the desire to keep less cash on hand (20 percent).

According to the study, nearly one in four respondents (23 percent) have moved away from cash and tried living daily life relying on cashless methods. Among them, eight in ten (80 percent) managed to live cashless for up to a few days while twelve percent managed to live for a week or more but less than a full month on cashless modes of payment. Meanwhile, another eight percent said they were able to live without cash for one month or more.  Photo Source https://web.facebook.com/VisaMM/

Photo Source https://web.facebook.com/VisaMM/

One of the most interesting questions in the Study is how long Myanmar respondents believe it will take for the country to become completely cashless. In this edition of the Study, 42 percent of the people surveyed believed it would take between 6 to 10 years, 21 percent thought it would take between 2 to 5 years, and two percent believed Myanmar could become a cashless nation within one year.

“While advances in payment technology can accelerate Myanmar’s integration with the global digital economy, it is equally important for us to understand consumer attitudes and preferences to payments. We are privileged to be able to share findings from this study and we hope it will continue to spark ideas and insights which will lead to societal progress in Myanmar,” Lillian Wang concluded.