Kanbawza Bank Introduces “Other Bank Transfer” Digital Transfer to Other Local Banks

KBZ Bank, Myanmar’s largest private bank, today announced the launch of its ‘Other Bank Transfer’ feature which enables KBZ iBanking and mBanking customers to transfer money to account-holders of other major Myanmar banks digitally.

The service, available 24/7 to both corporate and retail account holders of KBZ Bank, allows transfers of up to MMK 1,000,000 per transaction, with the daily transfer limit set at MMK 5,000,000. Each transfer is processed in under 15 minutes, and this efficiency replaces the time spent to prepare cash or a cheque and to bring it to the bank branch for processing. All transfers are PIN or one-time password (OTP) protected, with customers receiving SMS verification of their transfer within 10 minutes.  Photo Source https://www.facebook.com/KanbawzaBank

Photo Source https://www.facebook.com/KanbawzaBank

From 14 December 2020, KBZ Bank customers can use the ‘Other Bank Transfer’ feature to conveniently and quickly transfer money digitally to account-holders of Myanmar Apex Bank (MAB), Yoma Bank, uab bank, Myawaddy Bank, Rural Development Bank, and A Bank. Additional banks will be linked to KBZ Bank’s ‘Other Bank Transfer’ digital service in the future.

For KBZ Bank customers who wish to perform money transfers to other banks, they can continue to visit any of the Bank’s branches for over the counter support. Utilizing the Central Bank of Myanmar’s new CBM-NET2 system, these over the counter transfers will be processed by KBZ Bank and the corresponding bank much more efficiently than before.

By offering safe and secure digital transactions, the ‘Other Bank Transfer’ feature will also reduce the need for customers to make physical visits to bank branches at a time when people are being encouraged to stay at home and practice social distancing in response to the ongoing COVID-19 pandemic.

Digital interbank remittances made using the ‘Other Bank Transfer’ feature are not subject to over-the-counter transaction fees. Customers using the service are only required to pay the Central Bank of

Myanmar net charge of MMK 300 and a KBZ Bank charge of between 0.05% to 0.10% per transaction. The sender of the transfer will also need to pay inward remittance fees levied by their beneficiary’s bank.

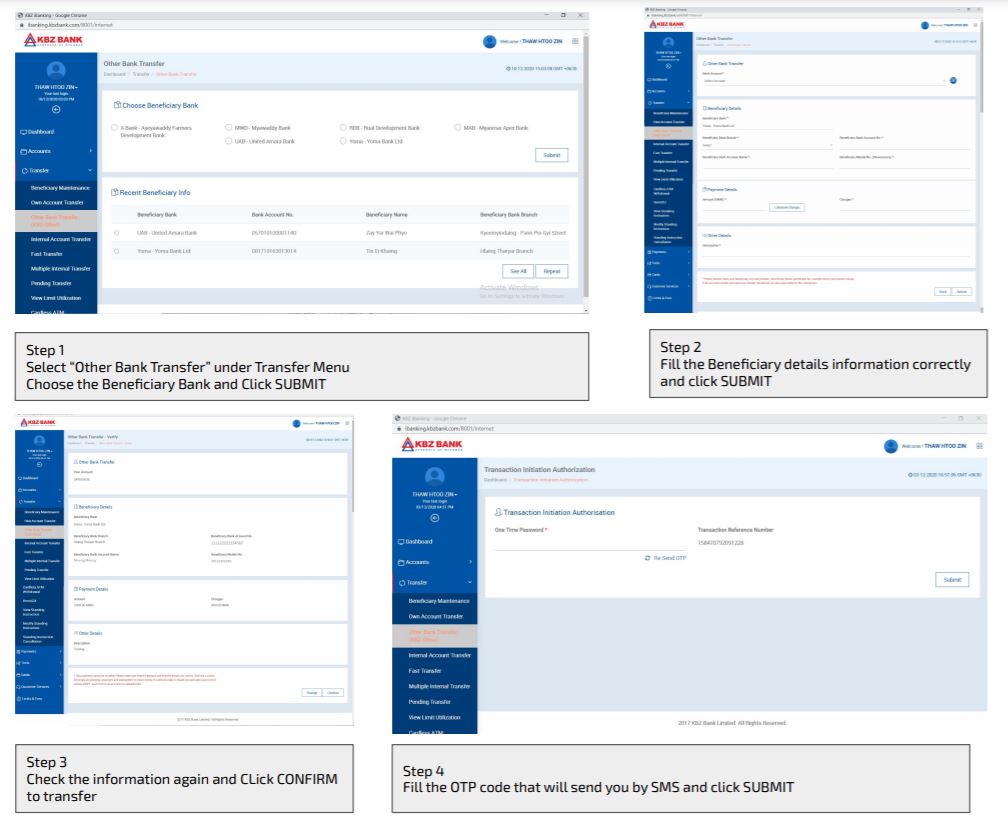

How to use the ‘Other Bank Transfer’ with KBZ iBanking:

(1) Open the KBZ iBanking website from an internet browser

(2) Select ‘Other Bank Transfer’ from the menu on the left-hand navigation panel

(3) Search for the beneficiary’s bank and enter their name, bank details and the transfer amount

(4) Review the transaction and confirm the beneficiary details by pressing “Submit”

(5) Enter the one-time password sent via SMS

(6) Await transaction confirmation sent via SMS – this will take up to 10 minutes

Photo Source https://www.facebook.com/KanbawzaBank

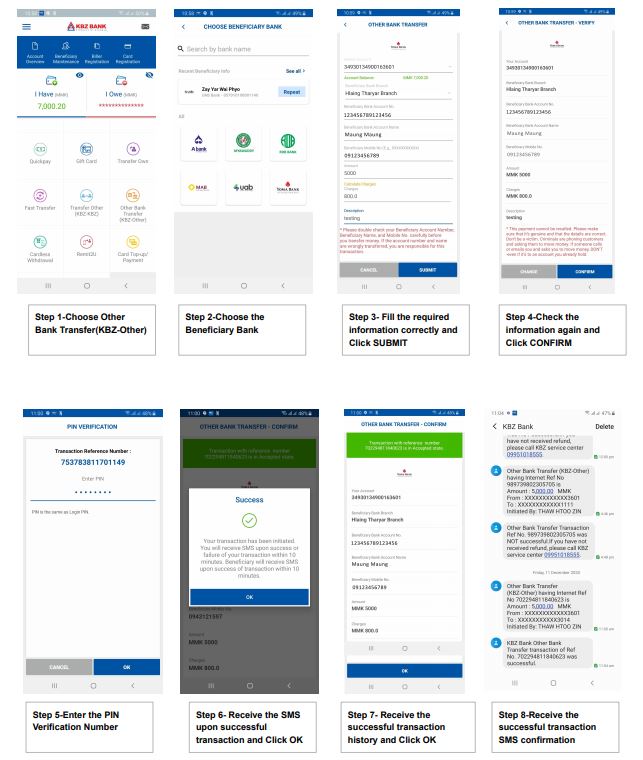

How to use the ‘Other Bank Transfer’ with KBZ mBanking:

(1) Open the KBZ mBanking app

(2) Select “Other Bank Transfer” from the home screen

(3) Search for the transfer beneficiary’s bank, enter their name, bank details, and the transfer amount

(4) Review the transaction and confirm the beneficiary details by pressing “Submit”

(5) Enter the mBanking PIN to verify identity

(6) Await SMS confirmation of transaction – this will take up to 10 minutes  Photo Source https://www.facebook.com/KanbawzaBank

Photo Source https://www.facebook.com/KanbawzaBank

KBZ Bank’s mBanking app is available in the Google Play Store and Apple App Store while the iBanking website can be accessed at https://ibanking.kbzbank.com/. KBZ Bank customers can find out more about eBanking by visiting https://www.kbzbank.com/mm/i-banking-2/ or contacting the KBZ Bank Customer Service Department at +959951018555.