KBZPay facilitates MMK 1.4 Trillion in Mobile Transfers in the first half of 2020

KBZPay, the leading mobile payment provider in Myanmar, continues to facilitate an increasing volume of money transfers month-on-month, with more than MMK 1.4 trillion transferred by customers from January to June 2020.

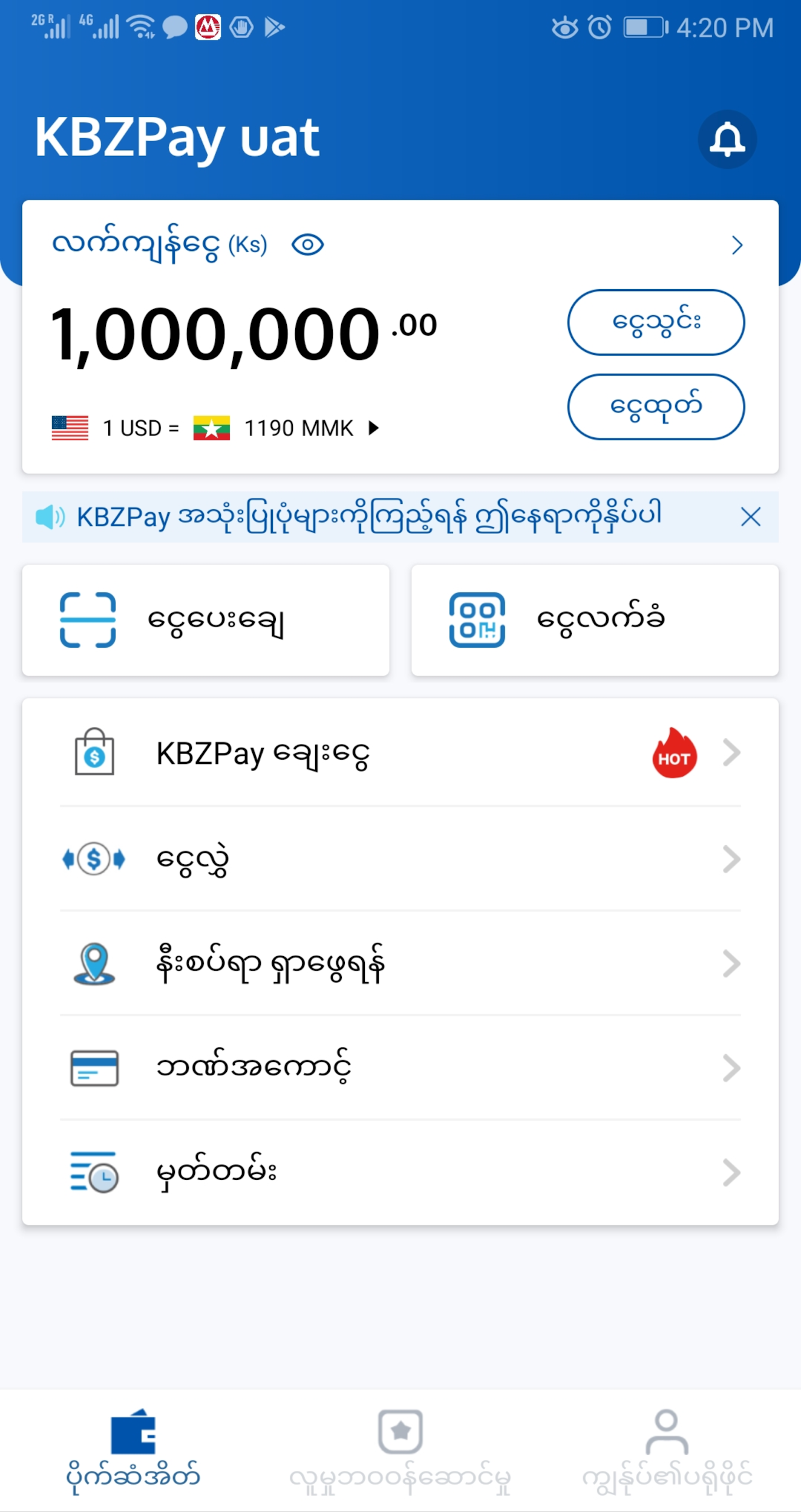

As the Myanmar population shifts towards mobile transactions, KBZPay has released an updated app version with a new look, intuitive interface, enhanced features, as well as expanded product and service offerings.

Photo source www.kbzpay.com

KBZPay continues to be a key driver of mobile financial payments across the country, a goal outlined in the Myanmar government’s COVID-19 Economic Response Plan (CERP). Designed to support a large and complex ecosystem, KBZPay is the country’s fintech leader and is enabling financial institutions, retailers, telecom operators, and other merchants to connect directly with their consumers.

From 1 January to 13 August 2020, KBZPay facilitated transactions valued at MMK 4.9 trillion, a 75 percent increase from the whole of 2019. Since April this year, KBZPay supported a surge in free, instant, 24/7 money transfers between registered KBZPay users, recording an 87 percent increase in transaction volume, and a 162 percent increase in transaction value. In July 2020 alone, these free, instant, customer-to-customer mobile transfers amounted to MMK 4.5 billion. While these results were in part due to the COVID-19 lockdown and stay-at-home measures, adoption and daily usage of KBZPay continues to rise.

Photo Source www.kbzpay.com

Mike DeNoma, Chief Executive Officer, KBZ Bank, says, “KBZPay brings financial inclusion to the people of Myanmar, with simple, fast and secure mobile transactions now offered in a new-look KBZPay app. With a KBZPay mobile wallet, you get more than just an app – you are connected to a network of more than 290,000 agents and merchants, have the ability to transfer money to others without incurring any fees and enjoy the convenience of paying bills digitally. Our customers are seeing the value that KBZPay brings to their daily lives. As evidence of this, customers’ KBZPay funds increased by 167 percent in June 2020 compared to January 2020.”

“As the trusted platform connecting consumers, merchants, agents, and suppliers across the country KBZPay are supporting the acceleration of Myanmar’s emerging digital economy. We believe KBZPay’s strong infrastructure will support businesses and communities nationwide to operate and live in this new normal and beyond,” he added.

Photo source www.kbzpay.com

KBZPay is a mobile wallet that connects people to a digital economy that was once out of reach for many. Introduced in 2018 in line with KBZ Bank’s ambition toward 100% financial inclusion to support Myanmar’s development ambitions and needs, KBZPay brings financial services beyond the physical branches of the bank and into the palms of customers’ hands.

Millions of customers now enjoy a new banking experience, using KBZPay to manage their money, pay for goods and services, store cash, remit to loved ones, and conduct daily financial tasks that were once labor-intensive and time-consuming. KBZPay utilizes the best and safest technology and with the support of KBZ Bank’s 18,000 staff, it is now the leading mobile wallet in Myanmar, connecting customers with thousands of merchants and agents across the country every day.

For more information, please visit www.kbzpay.com and www.facebook.com/KBZPay.