Core features that KBZPay users must know

Lately, more people are using Mobile Payment applications these days as they are very user-friendly. It is significantly increasing that people are using other Mobile Payment applications for their expenses not only the banking system. We are hereby describing some of the core functions of KBZPay that KBZPay users must not be missed.

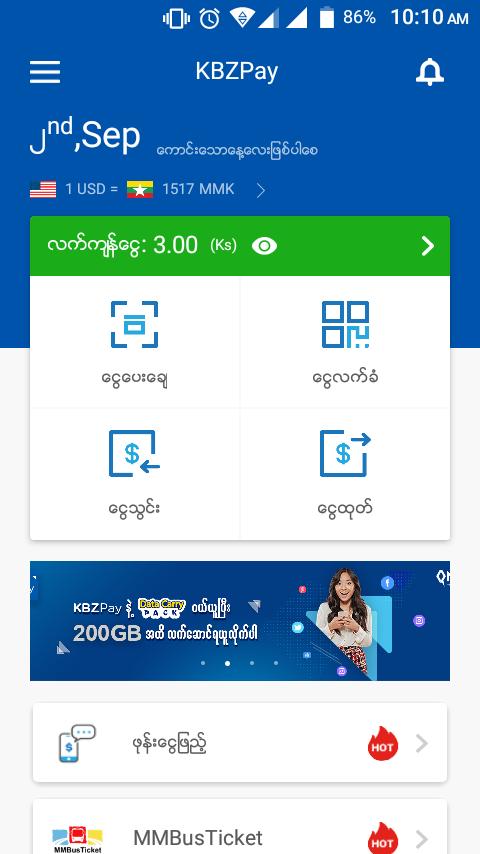

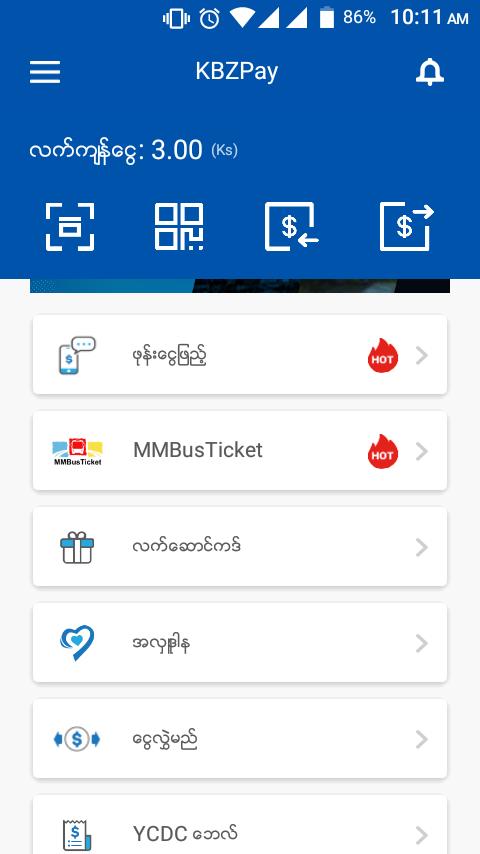

Benefits available from the KBZPay included are as follows – quick payments by scanning the QR Code involved in the KBZPay App when goods are being bought at the shops; money transfer within seconds between the KBZPay users; phone top-up payment for MPT, Telenor, MYtel, and Ooredoo; and no one can withdraw the transferred money without your permission.

Photo Source Screenshot By Myanmar Tech Press

Photo Source Screenshot By Myanmar Tech Press

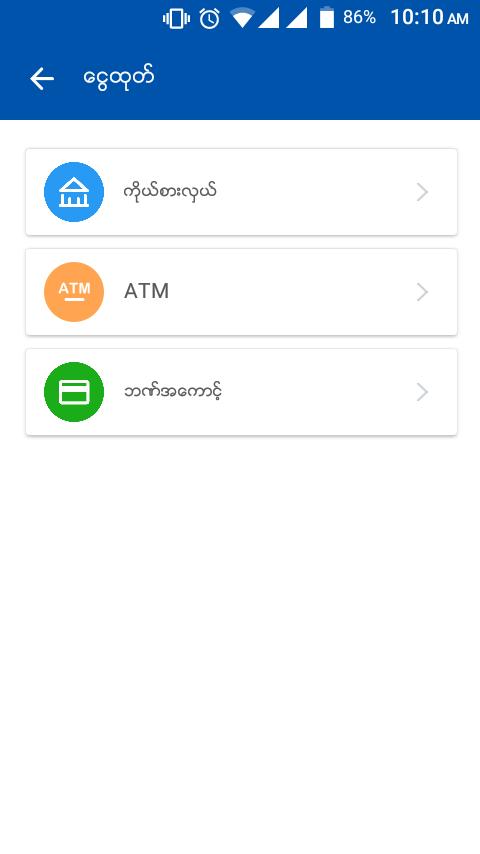

You can withdraw money from the KBZ ATM with the KBZPay. ATM Cash Out functions with the KBZPay are as follow. Normally, the ATM machine accepts the instructions only when it recognizes or confirms that the instructor is the owner of the card by matching the information through the ATM PIN of the EMV Chip (a magnetic chip). For the KBZPay ATM Cash Out, the numerical code provided by the KBZPay will be sent to the mobile phone. You will need only a few simple steps to cash out from the ATM from the KBZPay.

Photo Source Screenshot By Myanmar Tech Press

Photo Source Screenshot By Myanmar Tech Press

- Choose the ‘Cash Out’ from the main page of the KBZPay App.

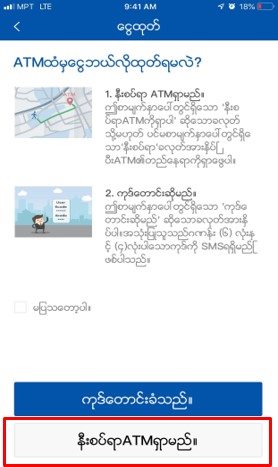

- Go to the nearest ATM machine of the KBZPay App. (If you are at the ATM machine, you can forward to the next step.)

- When you arrive at the ATM machine, click the ‘Request Code’ from the KBZPay. Then, enter your KBZPay password.

Photo Source Screenshot By Myanmar Tech Press

Photo Source Screenshot By Myanmar Tech Press

4. After you have entered your KBZPay password, the application will provide two PIN Codes with six digits and four digits in order to withdraw from the ATM machine.

5. Choose ‘KBZPay Cash Out’ at the screen of the ATM machine. Then, enter two PIN Codes that were sent to you from the above step.

6. Enter the amount you want to withdraw. Cash will be out when you click ‘Yes’. If the ATM machine suspects the attempt to withdraw money with the expired PIN Code, the withdrawal procedure will be cancelled

Photo Source Screenshot By Myanmar Tech Press

Photo Source Screenshot By Myanmar Tech Press

The following functions have to be done for using the KBZPay.

- For those who will deposit, choose the ‘Cash In’ at the main page of the KBZPay. You can the Cash In at the KBZPay agent near you. You won’t be charged for the Cash In. You will find easily the nearest KBZPay agent.

- For those who will withdraw, choose the ‘Cash Out’ at the main page of the KBZPay. Go to the nearest KBZPay agent and inform him that you are going to withdraw. Enter the phone of the agent and the amount that you want to withdraw. When you enter the PIN number, the process is accomplished and you can now withdraw the money.

- For those who will transfer the money, choose the ‘Transfer’ at the main page of the KBZPay. Enter the phone number to which money will be transferred. Enter the amount you want to transfer. Enter your password. If the process is accomplished, your transferring command is done. If you are going to transfer money to the phone number which doesn’t open the KBZPay account, it will say the phone number has no KBZPay account and you will have to answer phone number and other information of the recipient when you enter the phone number. The sender will have to provide six digits security code. The recipient can withdraw the cash at the KBZPay agent providing the SMS which has the four-digit code and the six-digit security codes provided by the sender.

- For those who will top up the mobile phone payment, choose the ‘Top Up’ at the main page of the KBZPay. You can choose the amount you want to recharge. This function will run conveniently for all telecommunication operators running in Myanmar. What is more, you can buy any preferred Data package for internet usage at one-stop. Likewise, buying tickets for express and highway travels; donation to the organizations allied with KBZPay; Bill payment; Pocket Money for your loved ones; and connect with and use the KBZ Bank account.

Photo Source Screenshot By Myanmar Tech Press

Photo Source Screenshot By Myanmar Tech Press

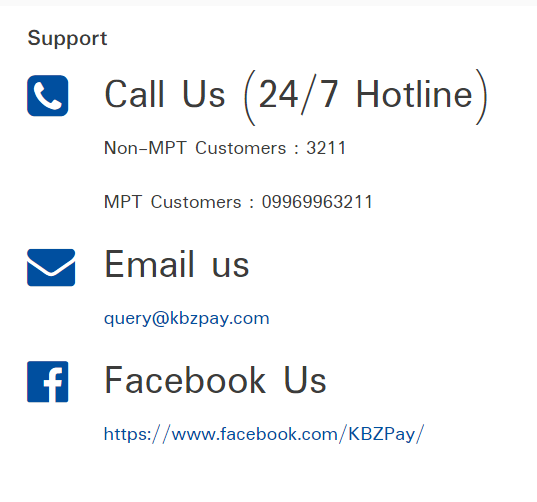

We hereby describe the contact numbers for services for changing phone numbers of the old account into the new number and for other services.

MPT Customers – 09969963211

Non-MPT Customers – 3211

Email Us– query@kbzpay.com

Facebook Us – https://www.facebook.com/KBZPay/