KBZPay Launches Shopper Loan; Myanmar’s First Digital Loan Service that Builds a Credit Score for Customers

KBZPay, the leading mobile wallet in Myanmar, has launched the KBZPay Shopper Loan to deploy an automated decision engine that uses machine learning techniques to determine the creditworthiness of customers.

The KBZPay Shopper Loan offers KBZPay customers who are salaried employees a fast and convenient way to obtain loans of up to MMK 5 million to purchase electronic products such as mobile phones and home appliances from any of KBZPay’s merchant partners nationwide.

The loan application process is managed within the KBZPay mobile app, making it paperless and fully mobile. Customers are not required to provide collateral, guarantors, or application fees and the loan verification period takes less than 24 hours to approve. The day after receiving approval on their loan, customers can make a purchase using the loan funds in their KBZPay mobile wallet and can make loan repayments in flexible monthly installments over 12, 18, or 24 months.

The KBZPay Shopper Loan is the first in a series of mobile app-based loan products that will leverage KBZ Bank’s automated decision engine. These loan products are designed to provide KBZPay customers with wider access to financial products and services and allow them to seek immediate and formal financing backed by the security and strength of KBZ Bank, the country’s largest private bank, instead of relying on informal lending channels or trying to save up for months. Furthermore, customers need not have to visit a bank branch or handle cash as they can use their KBZPay mobile wallet to make payments for product purchases, as well as loan repayments.  Photo Source https://web.facebook.com/KBZPay/

Photo Source https://web.facebook.com/KBZPay/

Mr. Chong Ho, Head of KBZPay and Unsecured Consumer Lending for KBZ Bank, says, “The KBZPay Shopper Loan, and other loan products that will soon be launched under KBZPay, reflects KBZ Bank’s commitment to address the financial challenges of people in the country, especially the working population. Through our investment in mobile technology and KBZPay, our customers can now enjoy a loan service that is paperless and which helps them to build a credit score for the future. Following loan approval, a shopper can simply head to our merchant partner and walk away with the purchase without worrying about making an initial payment or needing cash in hand.”

The new KBZPay Shopper Loan is Myanmar’s first digital loan service to deploy an automated decision engine to determine the creditworthiness of the customer. The twin powers of big data and advanced analytical techniques, coupled with high computing power, enable instantaneous calculation of a credit score and credit limit for each individual customer. This process leverages machine learning techniques to automatically determine each customer’s loan terms, minimizing the risk of personal judgment and human error. KBZPay Shopper Loan customers who borrow responsibly and repay their loans on time will receive good credit scores which will in turn lead to positive benefits in the future.  Photo Source https://web.facebook.com/KBZPay/

Photo Source https://web.facebook.com/KBZPay/

The KBZPay Shopper Loan is now available to Level 2 KBZPay customers in Yangon, Mandalay, and Nay Pyi Taw who are salaried employees drawing a monthly income of at least MMK 150,000. The loan product will be introduced in other cities and areas of the country in the coming months.

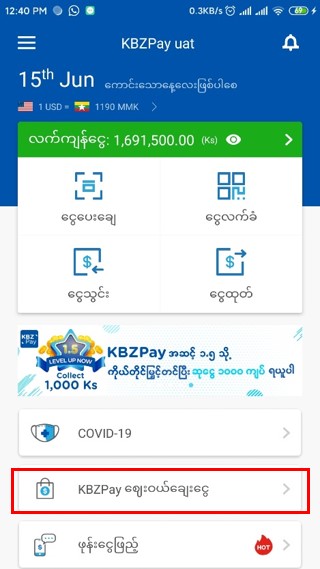

To find out more and to make a loan application, customers can tap on the “KBZPay Shopper Loan” menu item on the home screen of the KBZPay app. After clicking on ‘Apply Now’, the applicant can select the loan amount and duration of monthly repayments. The customer will then see an estimation of their loan amount, the interest applied, and the monthly repayment totals, before they proceed with the loan application. The final approved loan limit may differ from the amount shown in the loan calculator.

To proceed with the loan application, which only takes less than 15 minutes, the applicant will need ward recommendation (Should not be older than 1 month), Electricity Bill, and Pay Slip or Salary Recommendation from HR for the past three months.

After the loan application is completed, applicants will be required to watch a video about responsible borrowing and best practices for managing loan repayments.

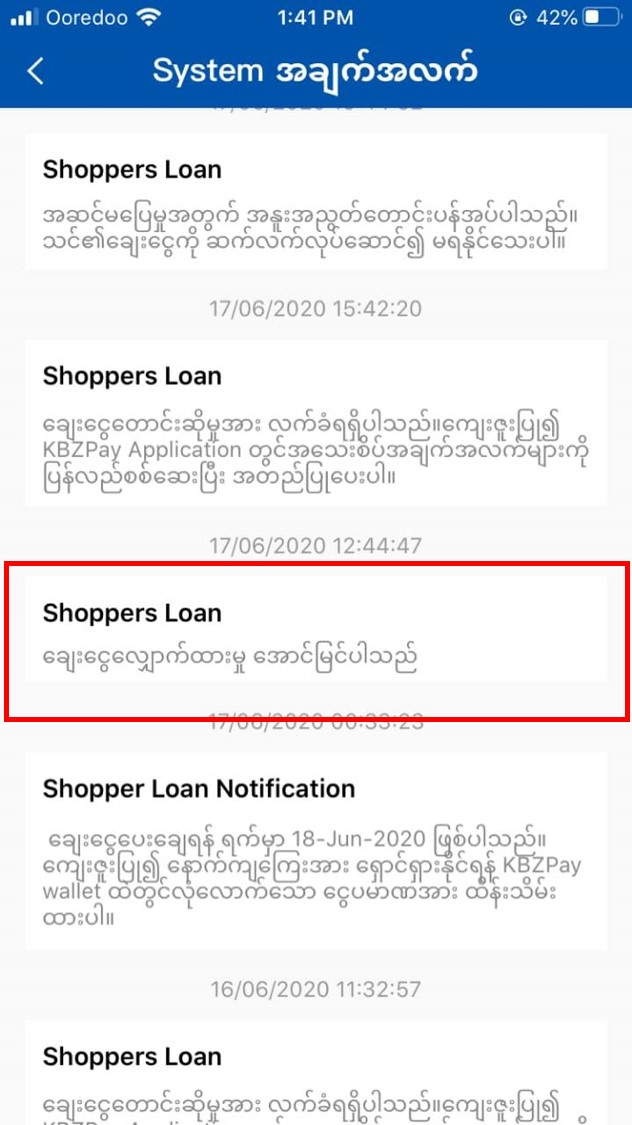

Following the 24-hour loan verification period, applicants will receive an in-app notification to confirm if the loan application is successful. Successful applicants will receive a QR code that will be scanned by the KBZPay merchant partner to complete the payment for the item purchased.  Photo Source https://web.facebook.com/KBZPay/

Photo Source https://web.facebook.com/KBZPay/

The loan can only be used for purchases at KBZPay’s Shopper Loan partner merchants, the majority of which offer mobile phones, electrical devices and home appliances. Loan recipients will not be able to cash-out the loan amount or transfer it to someone.

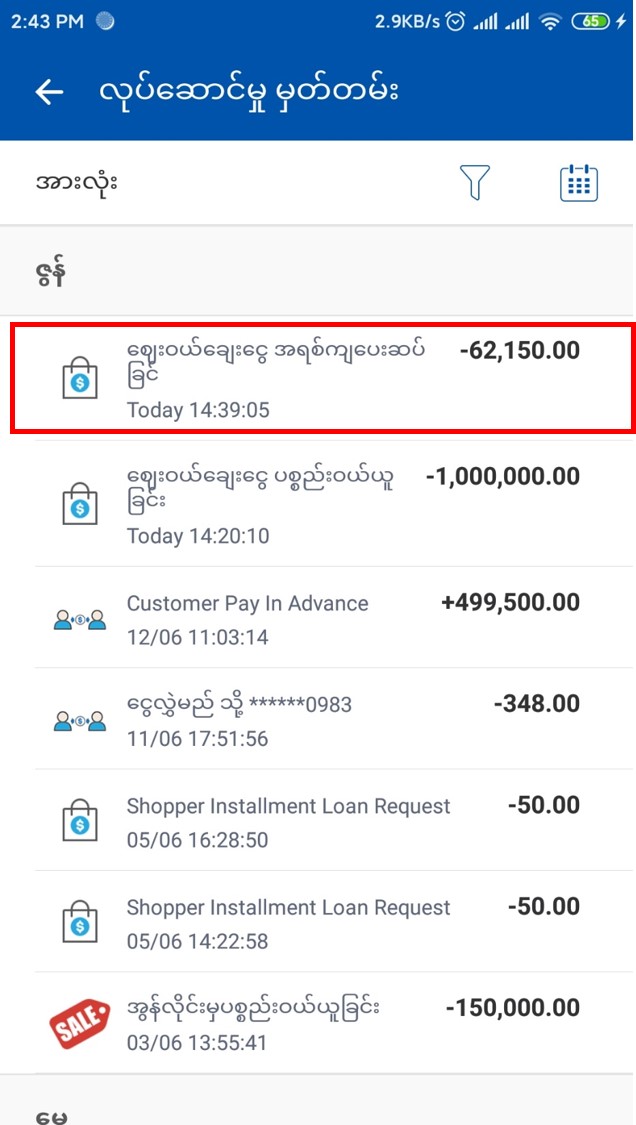

Loan recipients will need to make their loan repayments on the selected day of the month using funds in their KBZPay mobile wallet. All loan repayments will be reflected in the ‘History’ tab.

The KBZPay Shopper Loan merchant partners include leading retailers of electronic goods with branches across the country such as Technoland, Win Mobile World, and Snoopy Mobile. Outside of Yangon, customers can also obtain a KBZPay Shopper Loan to purchase scooters.

KBZ Bank encourages its customers to borrow responsibly and to prioritize borrowing for only what is needed. Some tips on how to borrow responsibly are to set a budget for the item to be purchased and do not look to borrow over the budget amount, allocate a portion of your monthly income to manage loan repayments, make loan repayments before each monthly deadline to avoid incurring any penalties, review your current loan balance regularly, and avoid obtaining several loans during a period of time.

For inquiries about the KBZPay Shopper Loan, members of the public can call the KBZPay Customer Service number: +959969963211.