Prudential Myanmar Launches the PRUFlexiprotect Product Series – Flexible Life Insurance Plans Tailored to Customers’ Needs and Goals

Prudential Myanmar Life Insurance Limited (Prudential Myanmar) introduces the PRUFlexiprotect product series, comprised of flexible life insurance plans which can be customised according to the needs of individual customers and group customers, which may be companies or groups of people. The PRUFlexiprotect product series gives customers the power to customise their protection plan, so they can enjoy peace of mind that their loved ones will be financially protected should death or critical illness occur.

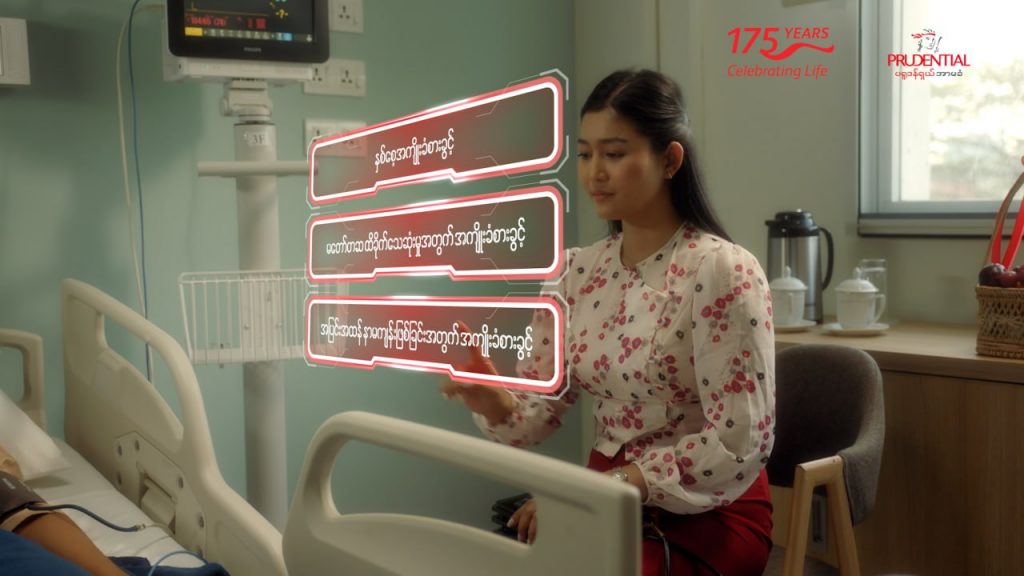

Image: Prudential Insurance

The PRUFlexiprotect base plan provides a cash payout in the event of the policyholder’s passing and it can be enhanced through add-on benefits. An example of an add-on benefit is Critical Illness coverage, which guarantees a lump sum payout if the policyholder receives a critical illness diagnosis. Prudential Myanmar is the first insurer in the market to provide early stage critical illness benefit cover. It advances 25% of the critical illness benefit upon early stage critical illness diagnosis. In the case of a late stage critical illness diagnosis, the policy pays the full 100% of the critical illness benefit, minus any early stage claim if applicable.

Other add-on benefits are Accidental Death Benefit, which provides a lump sum payout if the policyholder dies in an accident; and Double Indemnity protection, which doubles the payout amount of Accidental Death Benefit if the policyholder dies while being a passenger of a mass public transport.

Image: Prudential Insurance

U Naing Aye Lynn, CEO of Prudential Myanmar, shared that, “Life insurance protection is an important tool that empowers you to shape your future with confidence and provides the assurance that your loved ones will be financially taken cared of if something happens to you. At Prudential Myanmar, we recognise that our customers’ needs are different. That’s why we’re putting the power of choice back into their hands with the PRUFlexiprotect product series, your flexible life insurance policy.”

“Whether you’re an individual seeking to safeguard your family’s financial future, plan ahead in case of serious illness or unexpected life events, or a company aiming to secure your employees’ futures, PRUFlexiprotect is designed to cater to your unique requirements so you can live life on your own terms,” added U Naing Aye Lynn.

Image: Prudential Insurance

PRUFlexiprotect Plans

The PRUFlexiprotect product series is being launched with one life insurance plan for individual customers and two life insurance plans for group customers.

For individual customers, PRUFlexiprotect PLUS offers the flexibility to select coverage type, duration, and amount that aligns with their needs. Most notably, it guarantees the return of all premiums paid at the end of the coverage period. The coverage duration options are 10, 15, or 20 years and flexible payment options of annual, semi-annual, quarterly, or monthly are available. If no unfortunate event occurs, the customer gets back 103% of all the premiums paid.

Group customers, which may be companies or groups of people who are part of a society or cooperative, should have a minimum of five persons. PRUFlexiprotect 1 is a one-year term policy which offers a death benefit payout, ensuring financial security for the loved ones of those insured.

Another plan option for group customers is PRUFlexiprotect CI 1 which provides financial protection should the insured, such as an employee, be diagnosed with a critical illness. This plan is offered as a one-year term policy and ensures that the insured and their loved ones are eased from the financial burdens of critical illness treatment. In addition, it acts as a cushion to support the insured who may face potential income disruptions during the period of medical treatment.

Image: Prudential Insurance

PRUFlexiprotect Plans can be Customised with Additional Benefit Options

There are three protection benefit options that customers can add to their selected PRUFlexiprotect plan for enhanced coverage. These protection benefits offer reassurance to people who have concerns about health, the nature of their work, or accidents.

Accidental Death Benefit: Provides extra cash benefits if the insured passes away due to an accident, giving added protection.

Double Indemnity Benefit: Doubles the sum assured of Accidental Death Benefit if the insured dies in an accident while a passenger of a mass public transport.

Critical Illness Benefit: Offers cash benefits if the insured is diagnosed with early stage and late stage critical illnesses, providing financial support during challenging times.

Image: Prudential Insurance

Guided by its purpose of “For every life, for every future”, Prudential Myanmar seeks to empower people and communities in Myanmar to build their lives and future while being protected with life and health insurance.

In support of the launch of the PRUFlexiprotect product series, Prudential Myanmar is embarking on a multi-channel campaign to engage the general public. This campaign will encompass interactive games, on-ground events, and collaborations with a local cancer foundation to raise awareness about the importance of financial protection.

To learn more about the PRUFlexiprotect product series and additional protection benefits, visit https://www.prudential.com.mm/en/all-products/pruflexiprotect/. For enquiries and customer support, please call Prudential Myanmar’s hotline: +95 977 011 0010.